The Pakistani rupee exhibited strength for the second consecutive day against the US Dollar in the interbank market. Commencing trade at 283, it surged to the 282 level around 11:30 AM, marking a gain of approximately Rs. 1 during early-day trade.

Subsequently, the interbank rate experienced a brief dip to 285 between 1:30 PM and 2:30 PM before stabilizing for the remainder of the day. Open market rates fluctuated within the 284-286 range across various currency counters.

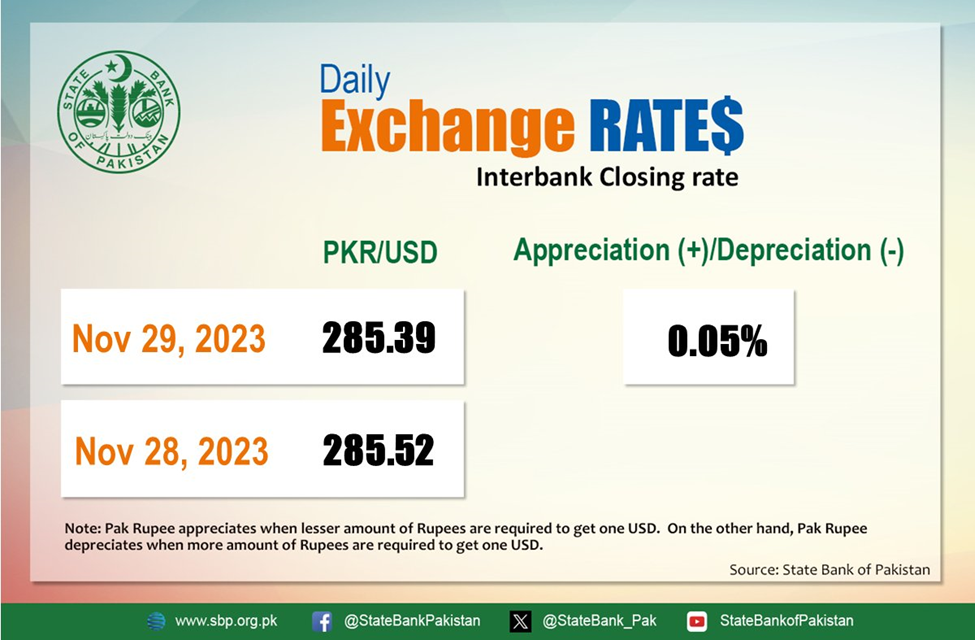

Closing at 285.39, the PKR appreciated by 0.05 percent, gaining 13 paisas against the dollar by the end of the day. This marks the second consecutive day of the rupee closing in the green.

Despite this short-term upward trend, the rupee has faced a broader decline, depreciating by nearly Rs. 69 since January 2023. Looking back to April 2022, the decline is even more significant, surpassing Rs. 116 against the US Dollar. Today’s observed gain of 13 paisas against the dollar indicates a minor reversal in this trend.

In a notable development, the International Monetary Fund (IMF) is in the early stages of crafting a policy document for a potential new bailout program for Pakistan. The IMF’s technical team is revisiting the 2019 policy document, aiming to tailor a new set of measures aligned with Pakistan’s current economic needs and challenges.

Discussions within the Ministry of Finance emphasize the generation of a comprehensive report outlining crucial reforms. Considering the substantial changes in Pakistan’s economic landscape since 2019, the objective is to provide a roadmap for economic development within the present-day scenario.

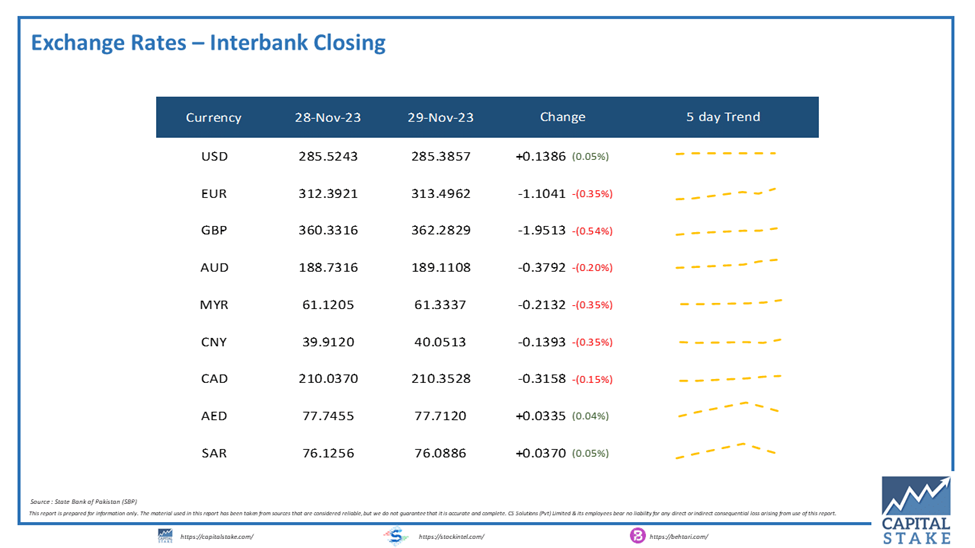

While the PKR demonstrated strength against most major currencies in the interbank market, it gained against the Saudi Riyal (SAR) and UAE Dirham (AED) but experienced losses against the Canadian Dollar (CAD), Australian Dollar (AUD), Euro (EUR), and British Pound (GBP) today. This dynamic currency movement highlights the complexity and volatility in the foreign exchange market.