The Pakistani rupee continued its positive trajectory against the US Dollar for the ninth consecutive day, opening at 283 in the interbank market and concluding the week with gains. By 11:30 PM, it exhibited bullish trends, reaching 278 during intraday trade, marking an approximate Rs. 4 increase against the greenback.

The interbank rate later dipped to 281, stabilizing at the 282 level for the remainder of the day, while open market rates remained steady in the 281-283 range.

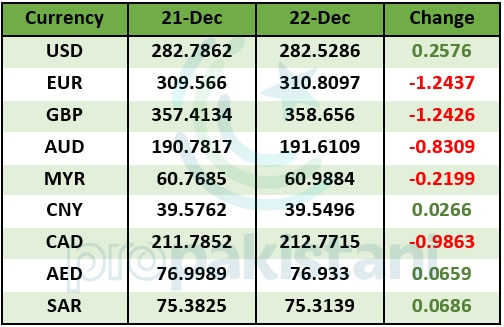

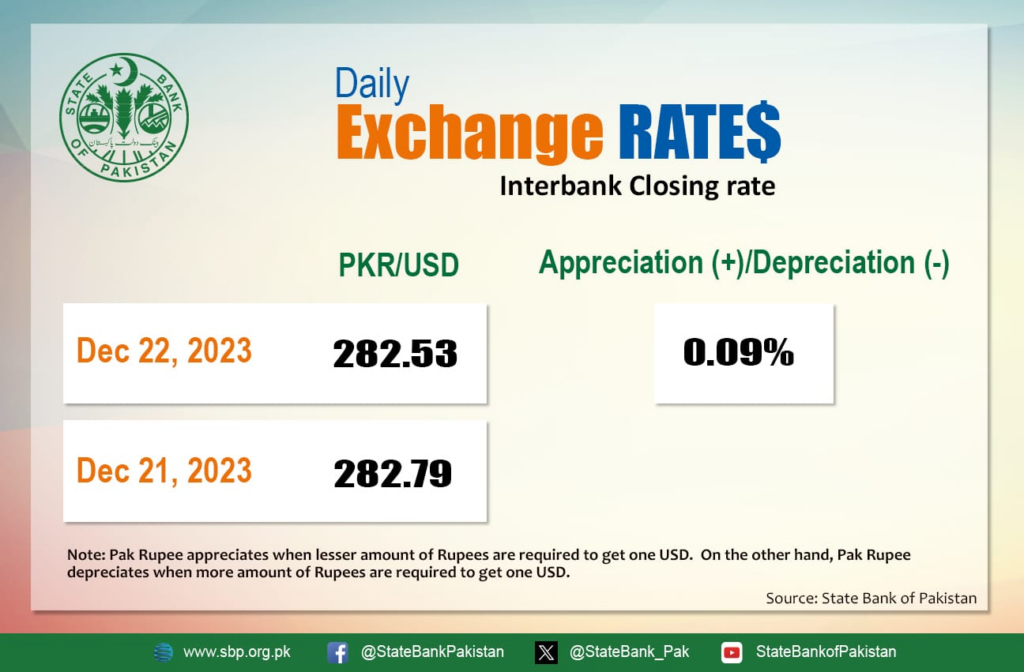

At the close, the PKR strengthened by 0.09 percent, finishing at 282.53 and gaining 26 paisas against the dollar. This marks the ninth consecutive day of the rupee closing positively. On a year-to-date basis, the rupee has experienced a 19.86 percent depreciation, while it has appreciated by 1.23 percent on a fiscal year-to-date basis.

Overall, since January 2023, the rupee has seen a decrease of nearly Rs. 64, and since April 2022, it has depreciated by over Rs. 111 against the US Dollar. In the observed exchange rate movements on the day, the PKR gained 26 paisas against the dollar.

Traders anticipate further gradual gains for the PKR after the long weekend, although they acknowledge the possibility of occasional drops in value, particularly as the government prepares for fresh fuel purchases in the upcoming weeks.

In contrast to its positive performance against the US Dollar, the PKR experienced depreciation against other major currencies in the interbank market. It lost 98 paisas against the Canadian Dollar (CAD), 83 paisas against the Australian Dollar (AUD), Rs. 1.24 against the Euro (EUR), and Rs. 1.24 against the British Pound (GBP). Conversely, it gained six paisas against the UAE Dirham (AED) and six paisas against the Saudi Riyal (SAR) in today’s interbank currency market.