The Pakistani rupee’s recent positive momentum against the US Dollar came to a pause today, starting the interbank trading at 280. Throughout the intraday trade, the currency remained relatively stable against the greenback, with minimal fluctuations.

Even after briefly touching 280 at 12:55 PM, the interbank rate eventually dropped back to 279, maintaining this level until the close of the market. Open market rates, observed across various currency counters, also stayed within the 279-280 range throughout the day.

Closing slightly higher at 279.66 against the dollar, the Pakistani rupee marked its seventh consecutive day of appreciation, albeit by a marginal 0.001 percent. Year-to-date, the rupee has appreciated by 2.25 percent, continuing its positive trend. However, it is essential to note that the overall performance shows a decline of nearly Rs. 60 since January 2023 and a significant drop of over Rs. 107 against the US Dollar since April 2022.

A notable event affecting market sentiment occurred on Wednesday, with below-average domestic bond performance leading market players to speculate that the central bank might lower the benchmark policy rate below 22 percent in the upcoming week. This development impacted market trends, resulting in a slowdown and a notable decrease in visits to currency counters compared to the previous day.

The week’s Treasury bill (T-bill) auction reflected a declining trend, with the rate on the 3-month paper dropping to 20.49 percent on Wednesday. Yields on the 6-month and 12-month papers also decreased to 20.4 percent and 20.2 percent, respectively. The government successfully raised funds through both competitive and non-competitive bids, accumulating a total of Rs. 185 billion, including Rs. 102 billion raised through competitive bidding and Rs. 82 billion through non-competitive bids.

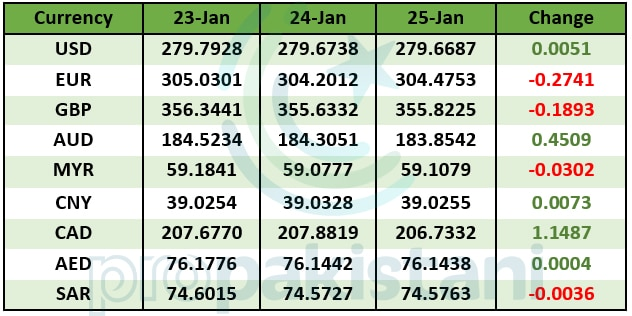

In the interbank market today, the Pakistani rupee demonstrated varied performances against other major currencies. It remained stable against the UAE Dirham (AED) and the Saudi Riyal (SAR) while gaining 45 paisas against the Australian Dollar (AUD) and Rs. 1.15 against the Canadian Dollar (CAD).

However, it experienced minor losses, with a decrease of 18 paisas against the British Pound (GBP) and 27 paisas against the Euro (EUR).