The Pakistani rupee experienced a reversal of fortunes against the US Dollar in the interbank market today. Commencing trade at 280, it displayed a bullish trend, reaching as high as 278 by 11:30 PM, marking a noteworthy gain of approximately Rs. 3 in intraday trade.

Subsequently, the interbank rate retreated to 282 but stabilized at 281 for the rest of the day. Open market rates were relatively stable, fluctuating within the 279-283 range across various currency counters.

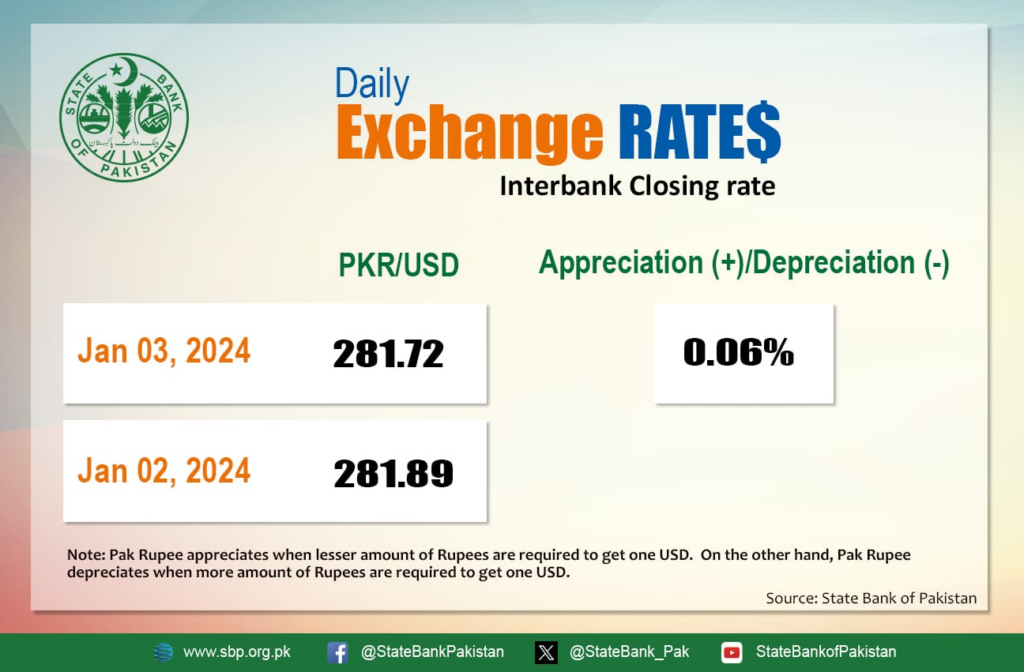

Closing at 281.72, the Pakistani rupee appreciated by 0.06 percent against the dollar today, gaining 17 paisas. This positive closure followed a pause in its 13-day winning streak on Tuesday. On a fiscal year-to-date basis, the rupee has appreciated by 1.51 percent. However, when considering a broader timeframe, it has depreciated by nearly Rs. 62 since January 2023 and over Rs. 109 against the US Dollar since April 2022.

In a significant development, some of the world’s leading money managers anticipate a favorable year for Pakistan’s dollar-denominated bonds in 2024. Investors are carefully assessing the risks associated with the upcoming elections, scheduled just a month before the expiration of the current IMF program in March.

There is a general expectation that the Pakistani rupee will gain substantial traction once the IMF disburses more funds to Pakistan. While brief cycles of bullish trends may persist throughout the remainder of FY24, forecasts for the end of CY24 present a less optimistic outlook. Analysts and brokerages predict a potential fall of the PKR to as low as 325 against the US Dollar by the end of December 2024.

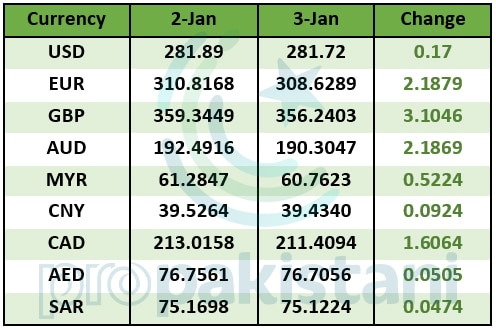

In today’s interbank market, the Pakistani rupee displayed strength against other major currencies. It gained five paisas against the UAE Dirham (AED), Rs. 1.6 against the Canadian Dollar (CAD), Rs. 2.18 against the Australian Dollar (AUD), and Rs. 3.10 against the British Pound (GBP). Furthermore, it appreciated by four paisas against the Saudi Riyal (SAR) and Rs. 2.18 against the Euro (EUR).