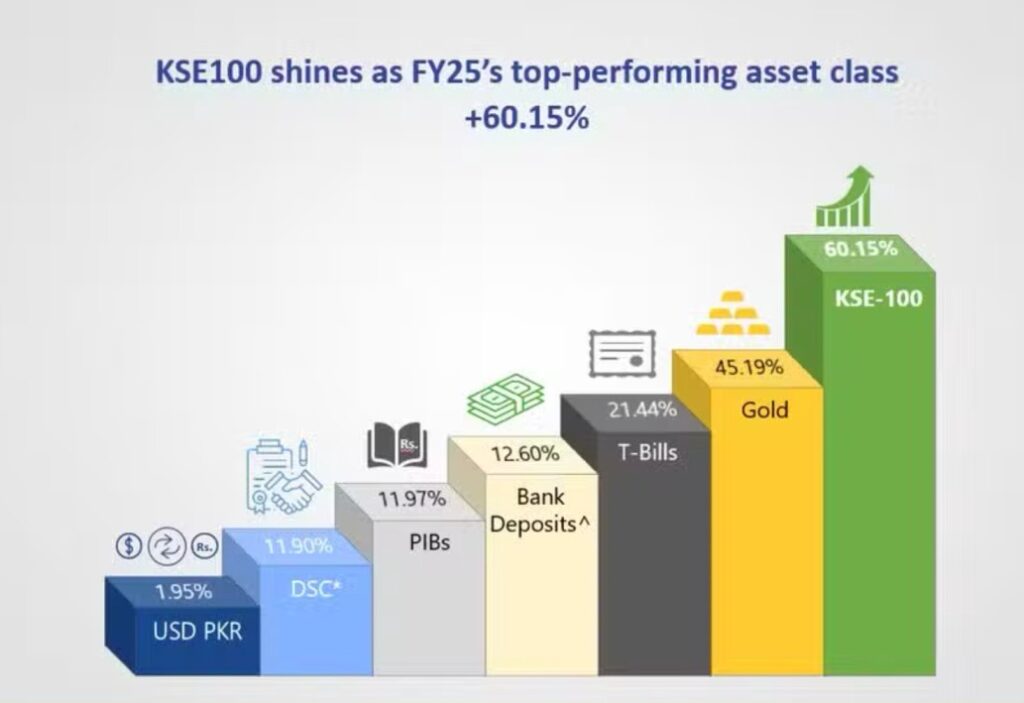

The KSE-100 Index posted a 60.15% return in FY25, outpacing gold, T-Bills, and all other asset classes. Experts cite improved liquidity, rate cuts, and sectoral growth as key drivers behind Pakistan’s top-performing investment avenue.

Pakistan’s KSE-100 Index closed the fiscal year 2025 as the best-performing asset class, boasting an impressive return of 60.15%. The rally surpassed gold (45%) and other traditional investment avenues such as treasury bills (21.4%) and bank deposits (12.6%).

According to Arif Habib Limited, the market’s stellar performance was driven by aggressive monetary easing, improved liquidity, and revaluation of undervalued sectors. These trends renewed investor interest and restored confidence in Pakistan’s capital markets, establishing equities as the most rewarding asset for the year.

As inflation trends stabilize and the government pushes economic reforms, the KSE-100 is positioned for further growth heading into FY26.