The Pakistani Rupee (PKR) exhibited a positive trend against the US Dollar for the second consecutive day in the interbank market, commencing trade at 283. At 11:30 PM, the currency demonstrated stability against the greenback throughout intraday trade, maintaining the interbank rate at 283. Open market rates fluctuated within the 283-285 range on various currency counters.

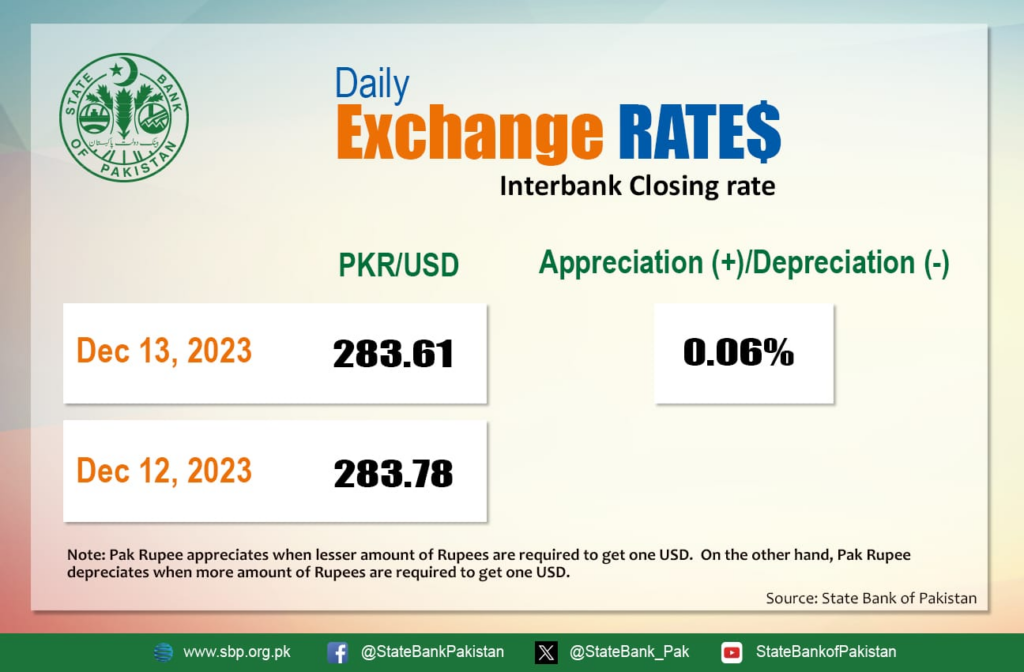

As the day concluded, the PKR appreciated by 0.06 percent, closing at 283.61 after gaining 17 paisas against the dollar. Despite this recent positive performance, on a calendar year-to-date basis, the rupee has experienced a depreciation of 20.16 percent. However, on a fiscal year-to-date basis, it has appreciated by 0.84 percent.

Over the course of the year, the rupee has faced challenges, witnessing a cumulative decline of nearly Rs. 66 since January 2023 and a more substantial drop of over Rs. 113 against the US Dollar since April 2022. In the latest exchange rate movements, the PKR gained 17 paisas against the dollar.

A significant development influencing the economic landscape was the decision of the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) to maintain the policy rate at 22 percent. The committee acknowledged potential implications for the inflation outlook but considered offsetting factors such as the recent decrease in international oil prices and improved availability of agricultural produce. The real interest rate, assessed on a 12-month forward-looking basis, remains positive, and inflation is expected to follow a downward trajectory.

Market observers noted that the evolving political scenario could impact growth if elections are delayed, affecting sentiments for foreign investors and exporters. Traders emphasized the importance of stability in forex market policies for sustained recovery.

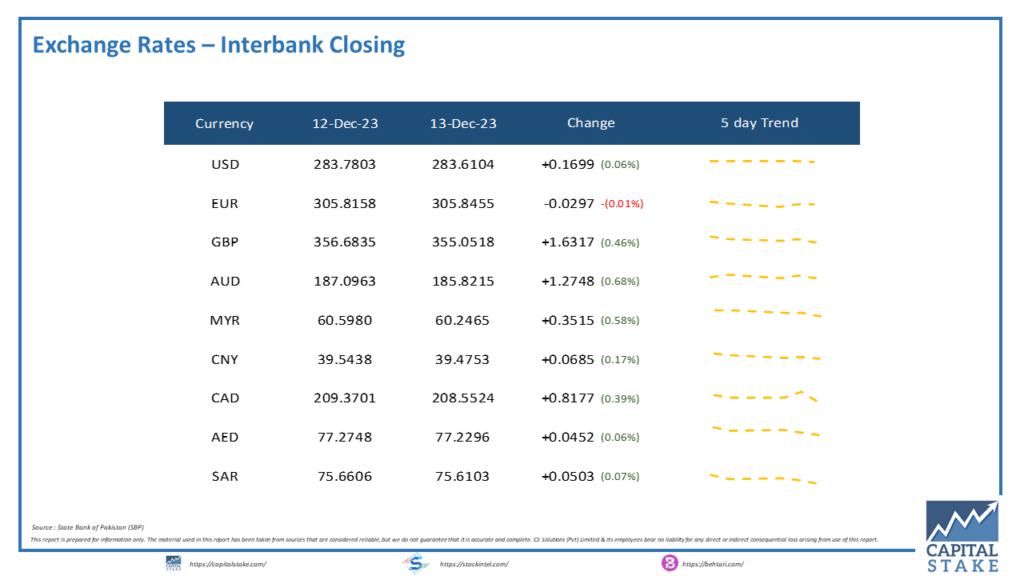

The PKR demonstrated strength against other major currencies in the interbank market on the same day. It gained against the UAE Dirham (AED), Saudi Riyal (SAR), Canadian Dollar (CAD), Australian Dollar (AUD), and British Pound (GBP). However, it experienced a minor depreciation of 3 paisas against the Euro (EUR) in the interbank currency market.

The foreign exchange market remains dynamic, with economic indicators, geopolitical factors, and policy decisions shaping the trajectory of the Pakistani Rupee.