The Pakistani rupee exhibited a modest ascent for the third consecutive day against the US Dollar, commencing trade at 282 in the interbank market. At 11:30 PM, it demonstrated bullish momentum, reaching 280, marking an intraday gain of approximately Rs. 1.5 against the greenback.

Subsequently, the interbank rate retracted to 281, maintaining stability at this level for the remainder of the day. Open market rates within the 280-282 range remained steady.

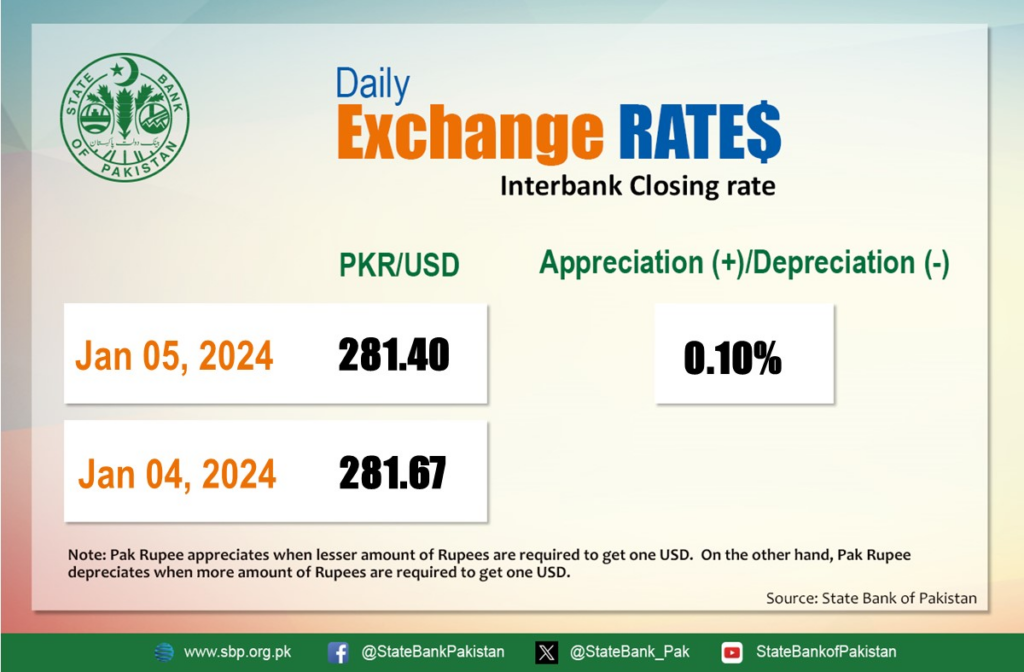

Closing at 281.4, the PKR appreciated by 0.10 percent, gaining 27 paisas against the dollar on the day. This positive trend continued for the third consecutive day, following a pause in its 13-day winning streak on Tuesday. On a fiscal year-to-date basis, the rupee has experienced an appreciation of 1.63 percent.

Despite this recent positive trajectory, the rupee has encountered a cumulative decline of nearly Rs. 62 since January 2023 and a substantial decrease of over Rs. 109 against the US Dollar since April 2022. Notably, the PKR gained 27 paisas against the dollar in the current exchange rate movements.

In a significant development, data from the State Bank of Pakistan (SBP) revealed a substantial increase of over $464 million in liquid foreign exchange reserves on a weekly basis. The overall liquid foreign currency reserves, including net reserves held by banks other than the SBP, reached $13.221 billion, reflecting a $365 million rise over the previous week. However, net reserves held by banks witnessed a decrease of $99 million during the same period.

Surprisingly, traders, initially anticipating losses due to the Senate’s decision to delay General Elections next month, observed the PKR closing in the green. Concerns were raised about the potential impact on the release of the next IMF tranche if the lender takes note of the decision at the upcoming Executive Board meeting.

In the interbank market, the PKR showcased strength against major currencies, gaining seven paisas against the UAE Dirham (AED), seven paisas against the Saudi Riyal (SAR), 72 paisas against the Euro (EUR), and Rs. 1.66 against the Australian Dollar (AUD). Additionally, it appreciated by 81 paisas against the British Pound (GBP) and 83 paisas against the Canadian Dollar (CAD).