In the third quarter of 2023, the profitability of listed banks in Pakistan surged to a record high of PKR 163 billion, marking a substantial 95 percent year-on-year increase. This significant boost was primarily driven by a substantial increase in Net Interest Income (NII) due to high interest rates and balance sheet growth.

In US dollar terms, listed banks’ profits also rose by 50 percent YoY to $560 million in the same period.

The NII for the banking sector reached PKR 481 billion in 3Q2023, a 70 percent YoY increase, as average policy rates remained at 22 percent, compared to 15 percent in 3Q2022. Interest income and interest expenses rose by 79 percent and 84 percent YoY, respectively.

However, non-interest income of the sector decreased by 5 percent YoY to PKR 79 billion in 3Q2023, mainly due to losses on securities and a decline in foreign exchange income. Non-markup expenses increased by 30 percent YoY to PKR 229 billion in 3Q2023, largely driven by higher administrative expenses in line with inflation.

Despite high interest rates, the provisioning charge for the sector declined by 9 percent YoY to PKR 14.7 billion in 3Q2023, mainly due to strong asset quality.

On a quarter-on-quarter basis, listed banks’ profitability increased by 24 percent in PKR and 22 percent in US dollars. This was primarily due to the absence of higher taxes recorded in 2Q2023, related to the implementation of a 10 percent super tax announced in the Federal Budget FY24. The effective tax rate for 3Q2023 was 48 percent, compared to 52 percent in 2Q2023.

In the first nine months of 2023, the sector’s earnings grew by 102 percent YoY to PKR 421 billion (a 44 percent YoY increase to $1.5 billion), driven by higher NII, which increased by 69 percent YoY. A lower effective tax rate of 48 percent in 9M2023, compared to 55 percent in 9M2022, also contributed to higher profit growth.

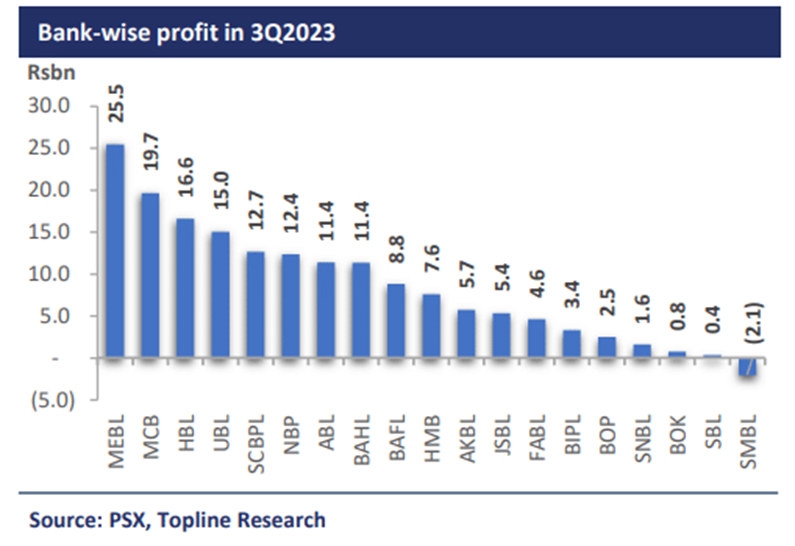

Meezan Bank (MEBL), MCB Bank (MCB), Habib Bank (HBL), United Bank (UBL), and Standard Chartered (SCBPL) were the top profit earners during 3Q2023. However, Summit Bank (SMBL) recorded a loss of PKR 2.1 billion in the same period.

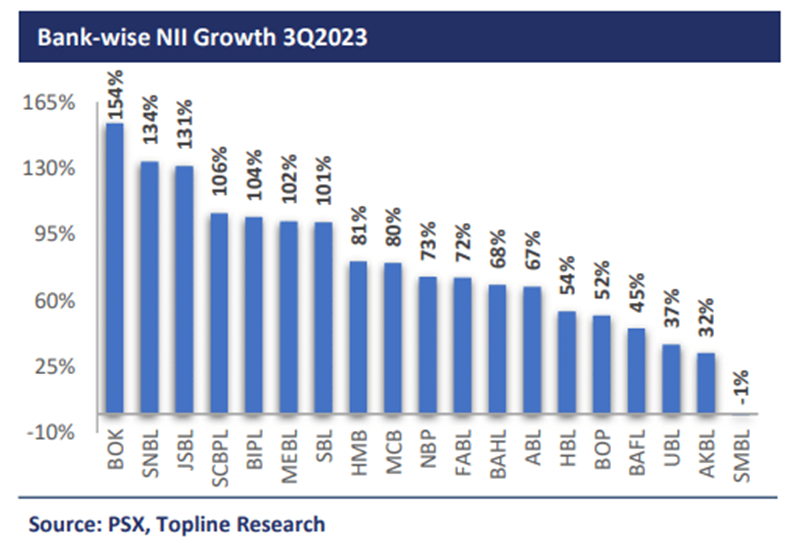

In terms of NII growth, Bank of Khyber (BOK), Soneri Bank (SNBL), JS Bank (JSBL), Standard Chartered (SCBPL), and BankIslami (BIPL) recorded the highest growth rates in 3Q2023.

The report anticipates a continued strong dividend payout from the sector given its robust profitability. Topline Banking Universe is considered to be trading at compelling valuations, with a 2023E PE and PBV of 2.7x and 0.7x and an ROE of 28 percent.

The report maintains an ‘Overweight’ stance on banks, with MEBL and UBL as its top picks.